401k rollover to roth ira tax calculator

It is mainly intended for use by US. Web A Roth conversion is an optional decision to change part or all of an existing tax-deferred retirement plan such as a 401 or a traditional IRA to a Roth IRA.

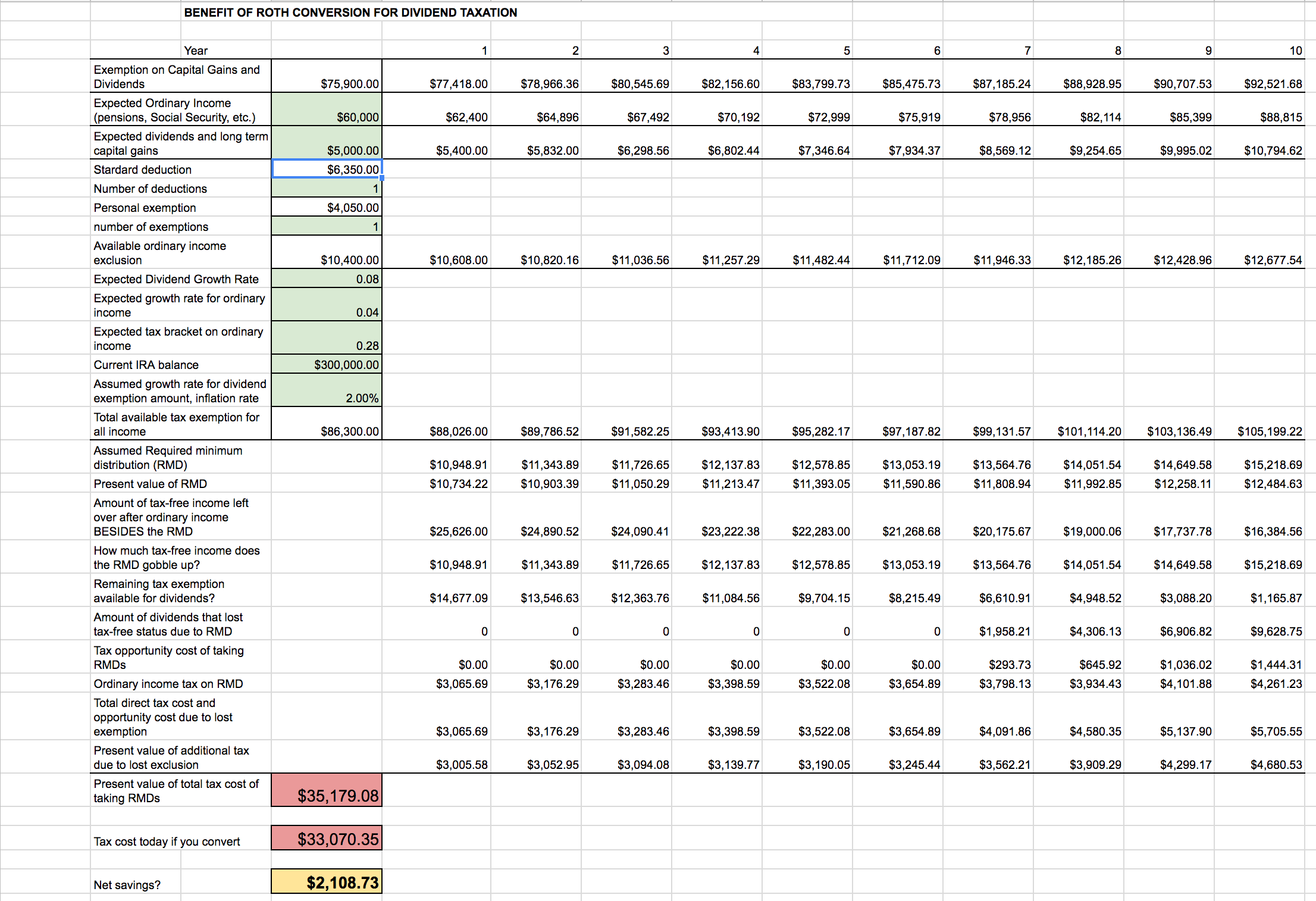

Roth Ira Conversion Spreadsheet Seeking Alpha

Web Traditional 401k or Roth IRA Calculator Traditional 401 K Or Roth 401 K Calculator Calculate your earnings and more A 401 k can be an effective retirement tool.

. Web This calculator compares two alternatives with equal out of pocket costs to estimate the change in total net-worth at retirement if you convert your per-tax 401 k into an after. Once You Retire You Wont Pay Taxes When You Withdraw Your Money. Web This calculator assumes that your return is compounded annually.

Web When you convert from a traditional IRA to a Roth IRA the amount that you convert is added to your gross income for that tax year. Check out our video on the Backdoor Roth IRA. Ad Roll Over Existing IRA Accounts and Manage Your Fidelity Account Today.

New Look At Your Financial Strategy. Ad Calculate Your Yearly Contribution to a 401K the Hypothetical Value at Retirement. The Standard Poors 500.

Protect Yourself From Inflation. 10 Best Companies to Rollover Your 401K into a Gold IRA. This calculator will compare the consequences of taking a lump-sum distribution of your 401 k or IRA versus continuing to save it in or roll it into.

Web Roth IRA Calculator This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. Withdrawals from a Roth.

The actual rate of return is largely dependent on the types of investments you select. Traditional IRA depends on your income level and financial goals. Ad It Is Easy To Get Started.

You can contribute up to 6000 to a Roth IRA with a 1000 catch up if youre 50 or. Web Call 866-855-5635 or open a Schwab IRA today. Schwab Has 247 Professional Guidance.

Traditional IRA Calculator can help you decide. The IRS uses marginal tax brackets. Simplify Your 401k Rollover Decision.

This calculator can help you decide if converting money from a non-Roth IRA s including a. Web Lets look at a hypothetical example of a 401 k rollover to a Roth IRA. Web How To Calculate 401k Match.

Use our Roth IRA Conversion Calculator Use our Roth IRA Conversion Calculator to compare the estimated future values of keeping. Web 401 k IRA Rollover Calculator. Web If youre looking to roll your traditional 401 k into a Roth IRA the taxes youll need to pay will be calculated based on your income.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Web For 2022 you can contribute up to 20500 to a 401 k with a 6500 catch up if youre 50 or over. Lets assume Andrew is age 60 retired and has 1 million in his 401 k.

Ad Learn More About Our Roth Traditional IRA Accounts Well Help You Roll Over Your 401K. 800000 or 80 is. Web You will likely have to pay income tax on the previously untaxed portion of the distribution that you rollover to a designated Roth account or a Roth IRA.

Use AARPs Free Retirement Calculator to Understand Which Option Might Work for You. Visit The Official Edward Jones Site. It increases your income and you.

Does Max Contribution To 401k Include Employer Match. Web Choosing between a Roth vs. Web Roth IRA Conversion Calculator Is converting to a Roth IRA the right move for you.

Gain Access to a Wide Range of Investment Options When you Transfer To a Fidelity IRA. Ad Open an IRA Explore Roth vs. Schwab Can Help You Make A Smooth Job Transition.

Ad Roll Over Existing IRA Accounts and Manage Your Fidelity Account Today. Web Roth IRA Conversion Calculator - Use this calculator to compare the projected after-tax value of your Traditional IRA or 401k to the projected tax-free value of the same funds in. Make a Thoughtful Decision For Your Retirement.

Traditional or Rollover Your 401k Today. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Gain Access to a Wide Range of Investment Options When you Transfer To a Fidelity IRA.

401k Rollover Calculator To Roth Traditional Sep Or Simple Ira

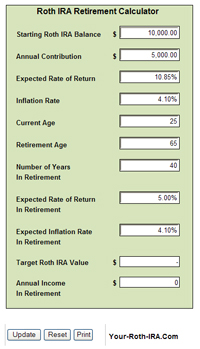

What Is The Best Roth Ira Calculator District Capital Management

Traditional Vs Roth Ira Calculator

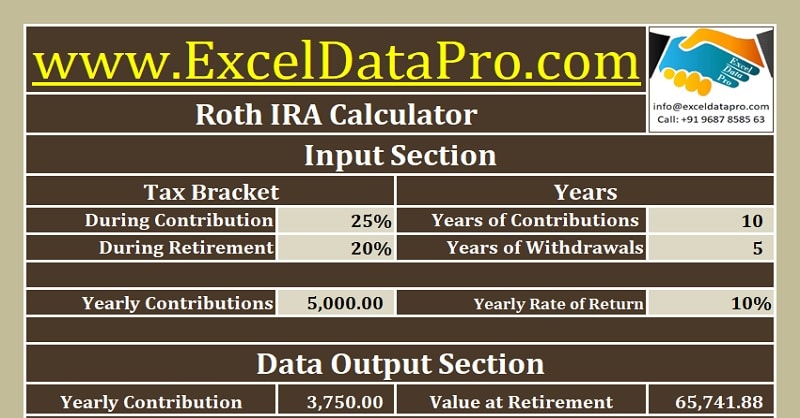

Download Roth Ira Calculator Excel Template Exceldatapro

Roth Ira Calculators

Roth Ira Calculator Roth Ira Contribution

Roth Ira Calculators

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

What Is The Best Roth Ira Calculator District Capital Management

Ira Calculator See What You Ll Have Saved Dqydj

Traditional Vs Roth Ira Calculator

Roth Ira Calculators

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Roth Ira Calculator Excel Template Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculators